Digital Banking Research

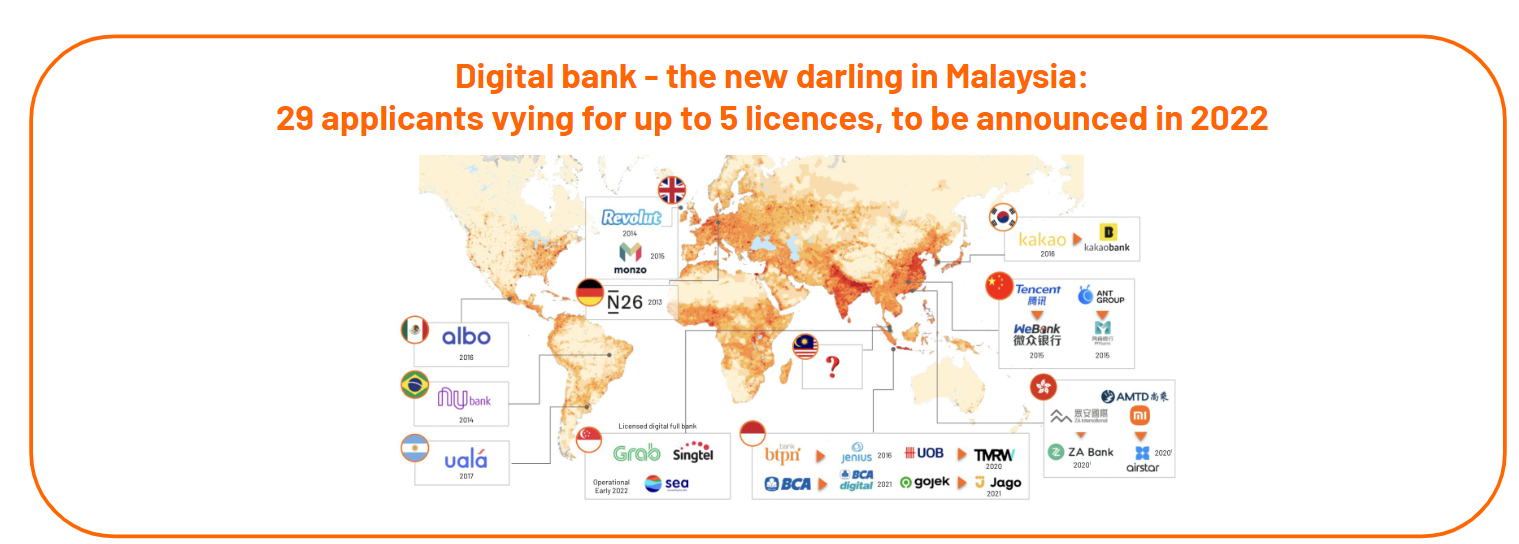

With one month left in the first quarter of 2022, the moment for Malaysia to unveil its first five digital banks is nearing. Non-bank entities in Malaysia may be able to conduct all banking services through platforms such as apps if they have a digital banking licence. There have already been 29 groups of contenders for digital bank licence since Bank Negara Malaysia (BNM) released the framework on December 31, 2020. However, sadly, BNM is granting up to five digital banking licences only to a group of 29 contenders. Countries elsewhere have previously granted qualifying companies digital banking licences. In 2019, Hong Kong issued licences to eight companies, including Tencent, Ping An, and Ant Group, to mention a few. In Singapore, the Monetary Singapore Authority (MAS) granted full digital banking licences to the Grab-Singtel consortium, and SEA Group.

What is digital banking and how does digital banking differ from online banking? Since all banks utilise various forms of digitisation, digital banking is sometimes conflated with online banking. Most people use the phrase “digital banking” to refer to any type of financial transaction that involves the use of technology. It has also been used to define financial services that are only available online and do not have physical locations. This contrasts with online banking, which applies to any transaction carried out electronically using the internet as a medium. Without needing to go into a physical bank, you may check your balance, transfer payments to other accounts, and browse their financial statements.

A digital banking licence would offer digital services to the authorities to conduct any financial activity like traditional banks over the border. It covers activities like opening an account, depositing and paying money, applying for loans, debit, and credit cards, and so on. For instance, Ant Bank in Hong Kong has collaborated with Alipay to launch a virtual banking unit that allows users to create personal bank accounts via the e-wallet app. This is also in accordance with BNM’s requirements, which call for digital banks to focus on financial inclusion in order to enhance long-term economic growth.

Companies must meet the following five major requirements to be eligible for a local digital banking licence:

- Ensure quality access to and appropriate use of financial services to enhance financial inclusion.

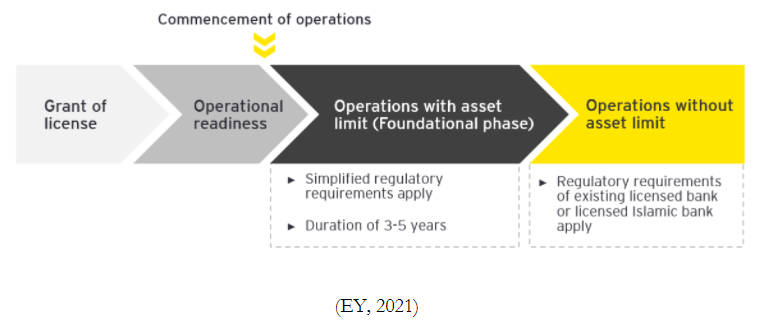

- In the first 3-5 years, maintain an asset threshold of no more than RM3 billion. (Foundational Phase)

- Comply with the requirements of the Financial Services Act (FSA) and the Islamic Financial Services Act (IFSA).

- Provide meaningful access as well as ethical and cost-effective financial solutions.

- RM100 million in capital funds would be used to ensure the integrity and stability of the financial system. (Foundational Phase)

Operational timeline for digital banks:

BNM examines applicants’ and relevant shareholders’ abilities to contribute to a proposed licenced digital bank in the following areas:

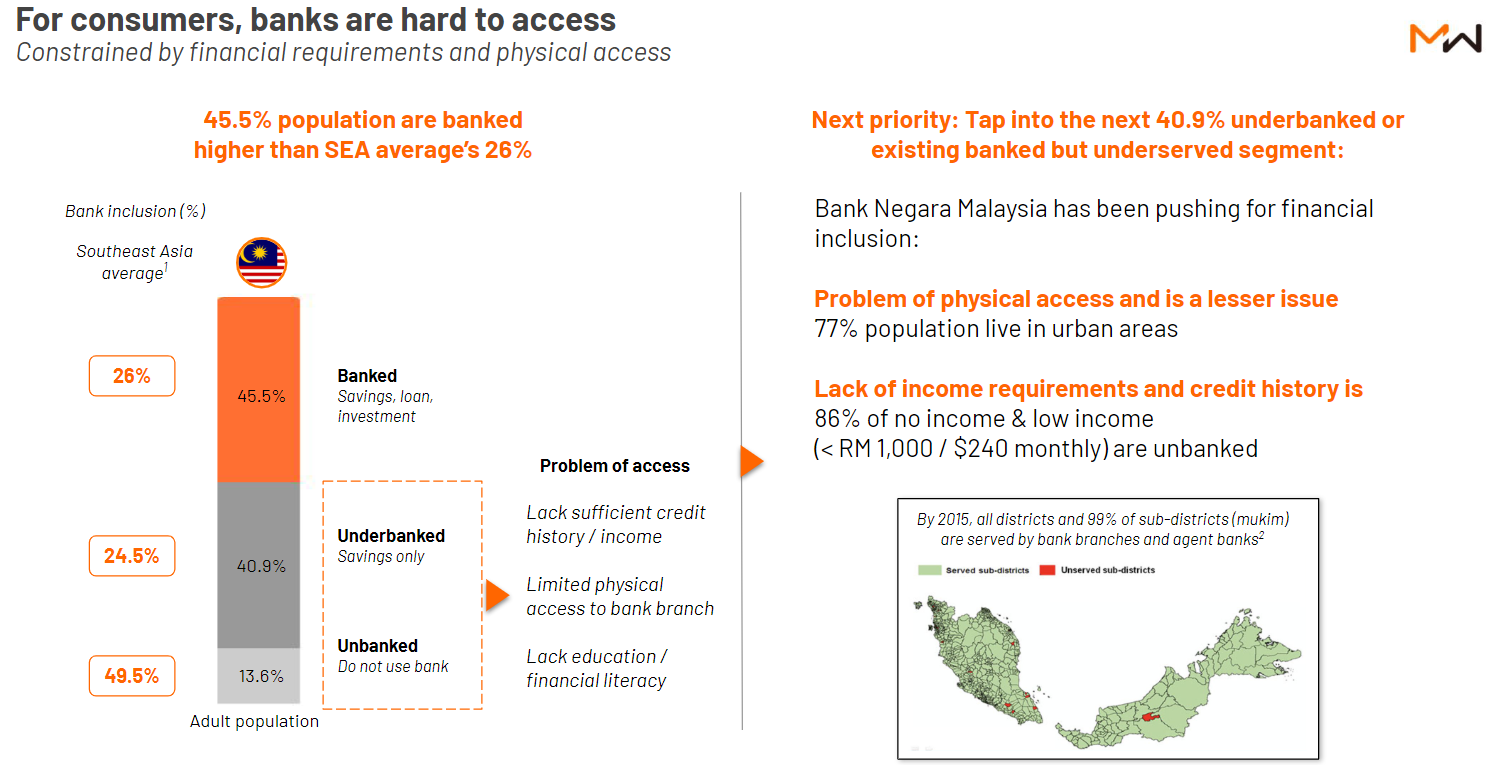

Financial inclusion, particularly for Malaysia’s neglected and unserved people, will have the greatest impact. Gig workers, for example, may use digital banking to assist them acquire loans. Since they do not have pay slips, which banks often demand as part of credit evaluation, many workers in the gig economy are unable to obtain financial products such as loans. Digital banks are able to cater to this demographic because of their distinct operational structures. Digital banking may also indeed make comparative financial services more accessible to individuals in rural regions, as they will not have to travel to urban bank locations. As an example, the launch of GO+ by Touch n Go’s e–Wallet is one way Malaysia has lately exhibited development in financial inclusion. Users may earn modest amounts of daily income by investing as little as RM10 with their micro-investment option. It is an alternative method for individuals who are not accustomed with higher-risk, longer-term investments, or for B40 groups that lack the necessary finances.

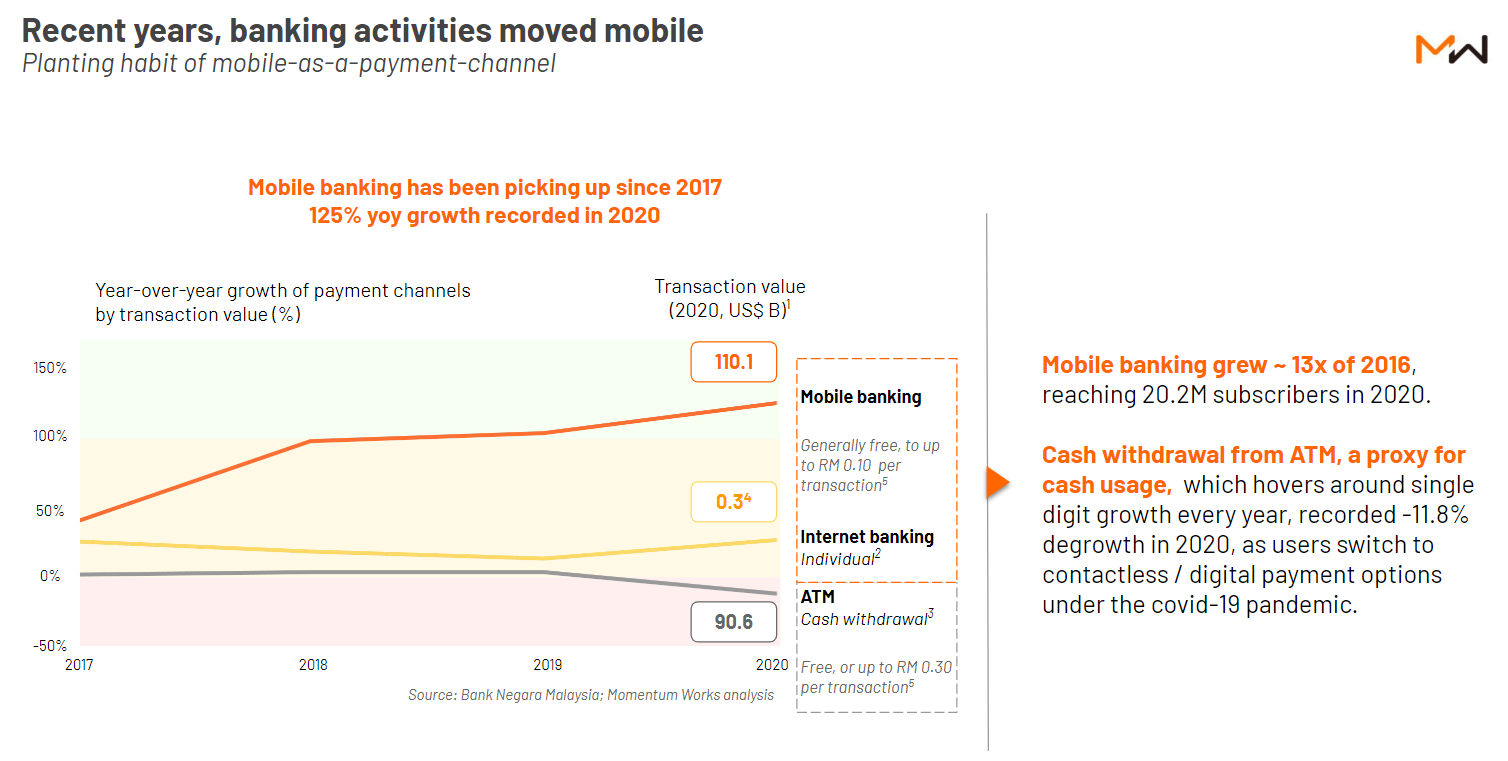

Furthermore, with the introduction of digital banking in Malaysia, M40 customers will have access to more customized financial services. It can also help firms adapt digitally, which is now mandatory pursuant to COVID-19. Digital banking makes shopping safer and more efficient, from cashless payment like QR code payments to e-commerce transactions. Simultaneously, because digital banks rely on self-serve technology and automation, the costs of financial services will be reduced for both individuals and businesses.

What do you think? Let us know in the comments section below!

Interesting post!

That is the proper blog for anybody who needs to search out out about this topic. You notice a lot its almost arduous to argue with you (not that I really would need…HaHa). You positively put a new spin on a topic thats been written about for years. Nice stuff, simply great!

Thanks for your comment, means a lot to us 🙂 Will be posting out more contents soon! Stay tuned!

I enjoy what you guys are up too. This type of clever work and exposure!

Keep up the wonderful works guys I’ve added you guys to my own blogroll.

holidays on gozo